|

www.HealthyHearing.com |

Can I get workers' compensation for hearing loss?Find out how to get help for hearing care

Contributed by Madeleine Burry Key points:

Workplace-related hearing loss is a common issue, especially as our world gets noisier.

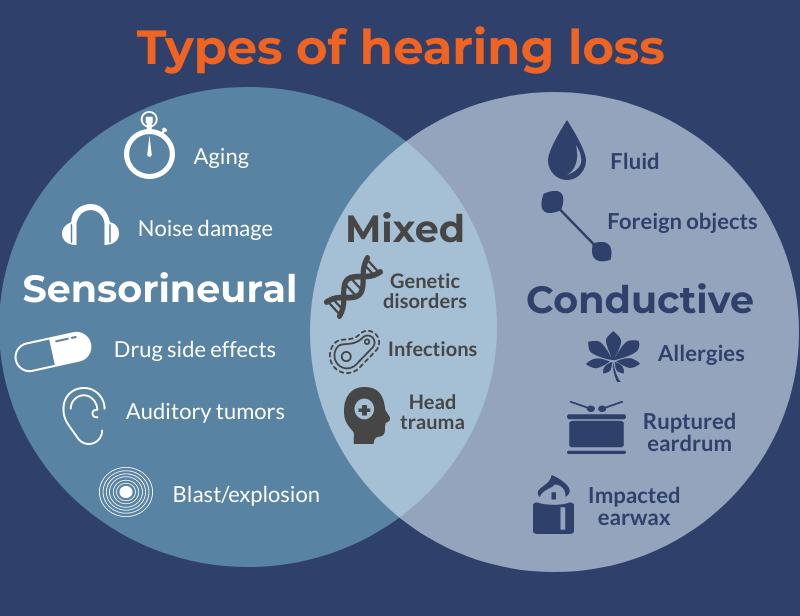

types of jobs can cause hearing loss. While noise-induced hearing loss (NIHL) can happen in every industry, it’s more likely to affect people who work in manufacturing, mining and oil/gas extraction, agriculture, construction and carpentry. Many military jobs also carry the risk of noise damage. If your hearing is damaged due to on-the-job conditions, you’re entitled to workers' compensation. But because hearing loss can develop slowly, it can be hard to know if you should file a claim. Here’s what you need to know about how the process works, from qualifying to making a claim. What is workers' compensation?Just as you likely have a car insurance policy to cover your bills in case you get into an accident, employers purchase workers' compensation insurance. Through these policies, your employer can afford to foot the bill for medical care and cover lost income if there's a workplace injury, notes the Insurance Information Institute (III). Coverage varies depending on your stateThere's a lot of variation from one state to another when it comes to workers' comp—that's true both for the level of coverage employers are legally required to purchase, as well as what the insurance covers when it comes to employee injuries. Workers' comp for hearing loss covers medical costs—that includes hearing aids, batteries, servicing, and so on, says Josh Frantz, VP of operations at Advanced Hearing Providers, which helps employers and employees manage the claim process. In general, most companies—from a bookstore to a construction company—must have some kind of workers' comp insurance. There are exceptions, however: Very small companies may not be required to purchase this insurance, for example. Benefits vary too from state to state, from the payout to cover medical expenses to the amount of wages that's protected. And, the amount of time you have to file a claim can vary as well. That's a big deal when it comes to hearing loss—while there's sometimes a traumatic brain injury that leads to immediate and noticeable hearing loss, more often, the degradation of hearing is slow and often hard to spot. Plus, sometimes it's hard to pin down a precise cause for hearing loss. For this reason, some companies may ask employees to take a baseline hearing test when they're hired. What’s behind work-related hearing loss?Before you file a claim, it helps to have some understanding of what may have caused your hearing loss. Occupational hearing loss occurs for two reasons: loud noise or ototoxic chemicals (solvents, nitriles, and other chemicals can damage the ears, or alternately, make them more susceptible to damage from loud noises). This may lead to hearing problems that fall into the following categories, according to board-certified audiologist Stelios Dokianakis of Holland Doctors of Audiology:

Noise-induced hearing loss typically causes sensorineural hearing loss. Head trauma and other physical injuries can lead to mixed or conductive hearing loss, Dokianakis says. Plus, some injuries can cause damage to the vestibular system (aka, the system that helps control your balance), leading to balance problems, vertigo, dizziness, and other issues related to a loss of equilibrium, he says. Finally, tinnitus—that infamous ringing in the ears—is another very common result of workplace injuries, Dokianakis says. How does a person qualify for workers' comp because of hearing loss?A tricky aspect of on-the-job hearing loss is determining the cause. “While in some cases there is a clearly defined problem (e.g., head injury or acoustic trauma from an exposure to a sudden extremely loud sound) in most cases hearing loss develops over time, from prolonged exposure to hazardous noise levels,” Dokianakis says. The end result: People often file claims well after the occurrence of the actual injury, Frantz says. For workers who have held many jobs, at many companies, untangling which employer is responsible can be challenging, he points out. The application process for workers' compOften, this process starts with someone realizing they have a hearing problem—this can occur because of symptoms (such as a struggle hearing conversation or tinnitus) or be prompted by a friend or family member’s observation of hearing difficulties. The next steps can sometimes be a bit of a snarl: People may get a diagnosis before making a claim, or may make a claim and then be prompted to visit an audiologist for back-up to the claim. If you opt to visit an audiologist first, file a claim before purchasing hearing aids, since you may be entitled to benefits that will cover those costs.

If the injury occurred at your current workplace, let your employer know. They will then provide you with paperwork to file a state-level claim. If your employer does not provide paperwork, or your have any questions about your starting point for a claim, check for instructions with your state-level insurance program, board or agency. “The first step is always using state-issued paperwork to file a formal claim with the employer where the injury occurred,” Frantz says. You can file a claim with a current employer, or a prior employer, although note that there is a limited time period (which varies by state) for when a claim must be submitted to be viable for coverage. Typically, the employer will then have you fill out forms detailing the injury and circumstances—these forms are then submitted to the employer’s insurance, as well as OSHA and state-level safety organizations, Dokianakis says. You’ll likely submit medical reports, or information from an audiologist, so if you have not visited an audiologist already, now is the time to do so. “Any hearing loss that was caused by or aggravated by a workplace injury can be grounds for a workers' compensation case,” Dokianakis says. If you suspect you have job-related hearing loss, it’s best to act sooner rather than later. That’s important for medical reasons: “Early intervention and appropriate hearing protection can prevent most cases of permanent occupational hearing problems,” Dokianakis says. Hearing loss & workers' compensation benefitsHearing loss is different from many other workers' comp claims, Frantz says. “It’s a unique little niche that doesn’t quite operate along normal lines of other injuries claims adjusters run into.” With other injuries, the goal is to achieve what’s referred to as the “maximum medical improvement” through treatment. That is, treatment options are exhausted. But hearing is a bit different from a back injury when it comes to treatment and potential improvement. “You don’t ever get your hearing back,” Frantz points out—so instead of improving the underlying medical situation, the goal is to provide you with the long-term usage tools needed to increase your hearing levels. Benefits vary widely from state to state. In Pennsylvania, for example, if you have permanent hearing loss, you’re eligible for 66.66 percent of your wages for a period of weeks determined by the severity of the hearing loss. Most states have a schedule determining the coverage of lost wages as a result of the injury. “It is important to note that hearing loss does not have to be profound or permanent to be considered a significant injury,” Dokianakis says. Is your workplace safe?Your employer should take the hearing conditions at the workplace seriously. Levels of safe noise and hearing conservation programs are determined by the Occupational Safety and Hazard Administration (OSHA). Along with risking employee injury, safety violations can be expensive for employers. Still, reporting can be uncomfortable. An employer may hang legally required OSHA signage in the office and have a “Days Since Last Injury” counter up, but still subtly discourage reporting. Do know that employers are legally prohibited from preventing workers from reporting injuries, and are eligible for citations for retaliatory actions, per OSHA. “Employers are responsible for their employees’ safety,” Dokianakis says. Madeleine Burry

Related Help Pages:

Prices Insurance & financial assistance

|

Featured clinics near me

Earzlink Hearing Care - Reynoldsburg

7668 Slate Ridge Blvd

Reynoldsburg, OH 43068

Find a clinic

Need a hearing test but not sure which clinic to choose?

Call 1-877-872-7165 for help setting up a hearing test appointment.

Madeleine Burry is a Brooklyn-based freelance writer and editor. She's written about health for several online publications, including Women's Health, Prevention, Health, Livestrong and Good Housekeeping. You can follow her on Twitter @lovelanewest.

Madeleine Burry is a Brooklyn-based freelance writer and editor. She's written about health for several online publications, including Women's Health, Prevention, Health, Livestrong and Good Housekeeping. You can follow her on Twitter @lovelanewest.